One of the most well-attended and discussed sessions yesterday at the Winter Institute featured the release of a new Civic Economics-ABA study called Amazon and Empty Storefronts: The Fiscal and Land Use Impacts of Online Retail, which aims to demonstrate the effects of the growth of Amazon on American towns and cities. The study determined that in 2014, the last year for which it could get full-year statistics, Amazon sold $44.1 billion of retail goods nationwide, which is "the equivalent of 3,215 retail storefronts or 107 million square feet of commercial space, which might have paid $420 million in property tax." Also in 2014, Amazon avoided collecting state and local sales tax of $625 million. Between uncollected sales tax and the loss of property tax, state and local governments lost more than $1 billion in revenue--about $8.48 per household in the U.S.--the study found.

Matt Cunningham of Civic Economics noted, too, that in 2014 Amazon book sales were about $5.618 billion, some 11.6% of Amazon retail sales. That amount of sales represents about 3,600 "bookshop equivalents and 40,000 bookstore employees," which he called "a sobering statistic."

The study noted that as of the beginning of this year, Amazon is collecting sales tax on purchases in 27 states--soon to be 28--which is helpful for some state and local governments, but that other trends continue to get worse. "The displacement of retail space from communities to the Internet... has contributed to a slowdown in the occupancy and development of commercial space," the study wrote. "This, in turn, has an invisible but certain impact on an essential source of revenue for most states, cities, and schools: property taxes." And Amazon's warehouses and distribution centers "on the peripheries of cities" are valued and taxed at lower rates than the spaces they are supplanting, often in downtowns.

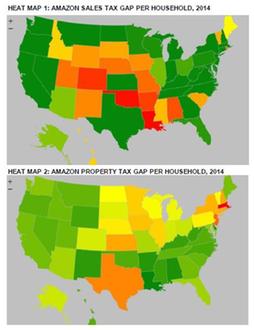

In an effort to make the results more usable for showing government officials at all levels the cost of Amazon to them, the study ranks the impact of Amazon on individual states in several categories. In the case of "sales tax gaps," Missouri has the largest gap, at $62 million, followed closely by Colorado, Louisiana and Alabama, each of which is more than $50 million. In the case of property tax losses and job losses, the states' order was more generally comparable to its population, with some exceptions.

At the presentation, Stacy Mitchell of the Institute for Local Self-Reliance emphasized that the study should serve as the basis for "generating a much bigger public conversation about the impact of Amazon," particularly with government officials at all levels. Too often, she said, those officials don't understand the implications of their decisions to support Amazon with ranges of grants and tax breaks and road improvements and the implications of not supporting independent, local businesses that provide so much value to towns and cities.

Mitchell noted that the current situation with Amazon reminds her of the monopoly on railroads in the 1800s, when "they were owned by industrialists who owned other kinds of businesses such as grain mills and steel mills and used transport to mess with competitors"--until the Interstate Commerce Commission was created.

ABA CEO Oren Teicher said that the "unprecedented study makes abundantly clear the deleterious effects on the American economy resulting from Amazon's strategy of retail dominance. It's our hope that the facts included in this report will help policy makers and the public better understand the need for more diversity in the marketplace, and recognize the potential long-term costs of the loss of healthy local economies."

Booksellers can see the study here.