In the many analyses of Borders's problems, people cite a

range of reasons, most notably the company's decision to outsource its

website to Amazon in 2001; a revolving door in the executive suite over

the past few years; expensive long-term leases; and a huge debt load.

But for us there were other factors that hurt Borders, some of the

company's own making, some it had no control over:

In the many analyses of Borders's problems, people cite a

range of reasons, most notably the company's decision to outsource its

website to Amazon in 2001; a revolving door in the executive suite over

the past few years; expensive long-term leases; and a huge debt load.

But for us there were other factors that hurt Borders, some of the

company's own making, some it had no control over:

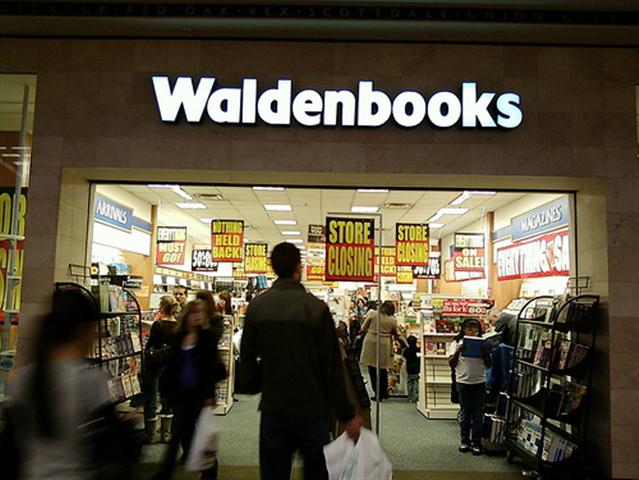

The purchase

of Borders by Kmart in 1992 was not so bad in and of itself, but Kmart's

decision to merge Borders with Waldenbooks, which Kmart had bought in

1984, was disastrous. From computers to company culture to focuses on

different types of readers, Borders and Walden were a bad fit, and

hobbled each other. For Borders in particular, the timing couldn't have

been worse: in the early '90s, chain superstores were beginning major

expansion, and Borders was distracted by the ultimately unsuccessful

effort to merge with Walden. Successive regimes at Borders never seemed

to  appreciate Walden, which at one point had some 1,300 stores, except

perhaps as a cash cow.

appreciate Walden, which at one point had some 1,300 stores, except

perhaps as a cash cow.

For many years, Borders, which was spun

off by Kmart and went public in 1995, had several CEOs from outside the

business--for some reason, two came from food retailing, notably Hickory

Farms and Jewel-Osco, and hired many other top executives from outside

the book business. While having some people from nonbook industries

could provide fresh air and helpful new perspectives, this tendency

seemed to have a corrosive effect on a company that in its early years

was famous for its knowledgeable booksellers and solid, deep selection.

One minor measure: it's been years since anyone has mentioned the

once-legendary book quiz given to prospective Borders staffers. Likely

most of the people running the company in the past few years wouldn't

pass it.

One of the worst ideas brought in from the grocery store

world was category management--the guiding principle of the company for

a good part of the last decade that involved publishers sponsoring and

managing sections--which maybe made sense for food retailing but was a

mind-numbing distraction for Borders and publishers alike when the

company should have been addressing some of its long-term problems,

developing its own website and preparing in other ways for the

electronic revolution.

One of Borders's early advantages--its

computer system, the creation of Louis Borders in the company's early

years--became dated after the Borders brothers sold the company to

Kmart. For many years, Borders and Walden continued to use separate

computer systems. In addition, the Borders system has continued to use

proprietary bar codes, which means that every book ever sold by Borders

has had to have a special sticker printed out and applied to it, usually

over the industry-standard bar code that is printed on all covers and

jackets now. Stocking and restocking in the Borders system lagged behind

its competition.

From our point of view, Borders's last chance

for a turnaround came during the period when George Jones, CEO from 2006

until early 2009, headed the company. He undertook a series of

initiatives, including extensive store remodeling, taking back the

company's website from Amazon, creating (again) a publishing program,

improving merchandising and buying processes. He also spun off most of

the international operations, which were usually  profitable,

but which many considered a distraction. Unfortunately, the financial

collapse in 2008 shook the company to the ground, bringing on the

Ackman-LeBow era of the past two years, when a hedge fund manager and a

corporate raider, both of whom represent the worst of American

capitalism, took over and drove the company into the ground.

profitable,

but which many considered a distraction. Unfortunately, the financial

collapse in 2008 shook the company to the ground, bringing on the

Ackman-LeBow era of the past two years, when a hedge fund manager and a

corporate raider, both of whom represent the worst of American

capitalism, took over and drove the company into the ground. The

record of William Ackman and Bennett LeBow at Borders has involved

inadequate investment, brutal staff cuts, the squeezing of remaining

employees, a revolving door in the executive suite, deals that seemed to

benefit them more than the company and other shareholders, deafness

about the company's problems and the hiring of more management with no

experience in the book world. Last year, who could not believe the end

was at hand when the new chairman and major shareholder of Borders

turned out to be a man who had a history of destroying companies,

"borrowing" from them, and whose claim to fame was taking over a

cigarette company?--John Mutter

The

record of William Ackman and Bennett LeBow at Borders has involved

inadequate investment, brutal staff cuts, the squeezing of remaining

employees, a revolving door in the executive suite, deals that seemed to

benefit them more than the company and other shareholders, deafness

about the company's problems and the hiring of more management with no

experience in the book world. Last year, who could not believe the end

was at hand when the new chairman and major shareholder of Borders

turned out to be a man who had a history of destroying companies,

"borrowing" from them, and whose claim to fame was taking over a

cigarette company?--John Mutter