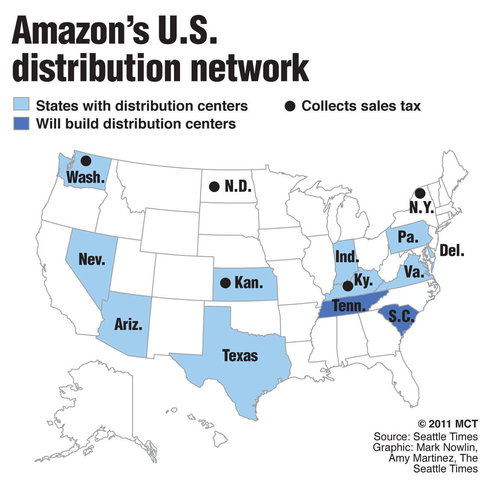

Will Amazon soon be collecting sales tax everywhere? Retail analyst David Strasser thinks so. He told Forbes:

"There's a lot of momentum building. Jeff Bezos has built a company

strategically around avoiding sales tax. But they're going to have to

deal with this." Forbes noted that "the battle has entered a

new stage as Amazon builds warehouse/fulfillment centers in more

locations, states grow hungrier for revenue, and a rising sales tax rate

(it now averages 9.64% nationwide) puts retailers who do collect tax at

an ever bigger disadvantage."

"I

think Amazon is starting to overplay their hand with what they're doing

in Texas and Tennessee. I'm not an advocate for bricks and mortar

retailers. But Amazon is gaming the system," said Strasser, who believes

the backlash regarding fulfillment centers is significant "because both

the competitive market place and Amazon's ambitions require it to

continue building. As Best Buy and Wal-Mart get more efficient at

distributing items purchased on the web, Amazon has to have warehouses

nearer its customers, he says. He also points to a Wall Street Journal

report last month that Amazon is considering selling fresh groceries,

which would require even more of a local presence wherever that service

is offered," Forbes wrote.

---

South Carolina has joined Texas and Tennessee in questioning Amazon's tax breaks. The Associated Press (via the Washington Examiner)

reported a planned distribution center "that became one of former

Governor Mark Sanford's last big economic development deals has become a

headache for Governor Nikki Haley, legislators and possibly South

Carolina's economic development image."

"It's a tough situation,"

Haley said. "I've had to take on all these issues where I've had to

check: What's the background on this? How did we get here? What

happened?... I don't want us to be known as the state that doesn't keep

our promises. But the second side of it is when I go and I

push for economic development, I want to make sure that we're being

fair to the companies that are coming in and to the companies that we

already have in this state."

A law passed in 2005 that "made it

clear big distribution centers didn't open out-of-state businesses to

sales tax collections just because they shipped goods from South

Carolina" expired last June. The state commerce department "promised

Amazon that they would work to get the law back on the books--but with a

new exception for Amazon. The company operates Createspace, a book

publishing operation in North Charleston. Amazon wanted to make sure

Createspace also did not have to collect sales taxes," the AP wrote.

Jill Hendrix, owner of Fiction Addiction, Greenville, and a SIBA board member, said, "We would like for that to be off the table completely."

---

Amazon has thrown down the tax gauntlet in California,

threatening to sever ties with affiliates if the state government passes

legislation requiring the company to collect sales tax on items sold to

residents. In a letter to California's Board of Equalization, Amazon

said four bills introduced to the state legislature "are

unconstitutional because they would ultimately require sellers with no

physical presence in California to collect sales tax merely on the basis

of contracts with California advertisers," the Wall Street Journal reported.

In a letter to State Board of Equalization member Senator George Runner, Paul

Misener, Amazon's v-p for global public policy, wrote: "If any of these

new tax collection schemes were adopted, Amazon would be compelled to

end its advertising relationships with well over 10,000 California-based

participants in the Amazon Associates Program." Misener

also warned that "similar legislation in other states has,

counterproductively, led to job and income losses and little, if any,

new tax revenue."

Runner observed: "In no uncertain terms, Amazon has made it clear to me

that the checks they send Californians will be cut off overnight if

pending legislation aimed at regulating their operations becomes law."