E-Books: Barnes & Noble, Case Study for World Booksellers

Shockingly, the digital transformation of the book world was the top subject at conferences held before the official start of the Frankfurt Book Fair today. Many book people outside the U.S. wanted to learn about the American experience, and talk about how the digital wave in their countries resembles and sometimes differs from the U.S. model.  Publishers Launch organizers Mike Shatzkin and Michael Cader held up Barnes & Noble as an important example to booksellers around the world of how a traditional, homegrown bookseller can remake itself and respond to the wave of retailers selling e-books and printed books online. (Read: Amazon.)

Publishers Launch organizers Mike Shatzkin and Michael Cader held up Barnes & Noble as an important example to booksellers around the world of how a traditional, homegrown bookseller can remake itself and respond to the wave of retailers selling e-books and printed books online. (Read: Amazon.)

Speaking at the Monday conference, Jim Hilt, B&N's v-p of e-books, proudly noted that in the 18 months since B&N re-entered the digital world (it had shut down its earlier effort in 2003 because the market wasn't there yet), B&N has gained 25%-28% of the e-book market in "a very competitive landscape with a dominant player, Amazon."

B&N continues to believe that its 700 stores are a strategic advantage, Hilt said, because "for those who are not tech savvy, being able to walk into a store and talk with one of our 40,000 booksellers helps."

B&N employees took quickly to selling the Nook and e-books, Hilt said. "Initially it seems like a hurdle, but the minute we put a Nook into the hands of a bookseller, they got it." Booksellers, he continued, know how to sell great content, and "new technology is the delivery mechanism for great content. We were just asking the booksellers to focus on what they do best already, which is talk about books."

Theresa Horner, B&N's v-p, digital content, said that an important reason for the company's success in digital sales stemmed from the stores' involvement in the development of the Nook from the beginning. "We had meetings weekly, and the store people were talking about how to sell it in the stores from the start." The company created training materials, videos, faqs and more for its booksellers. "It was all very coordinated," Horner added.

In addition, as the Nook was developed, people from the stores helped to drive "content awareness in both formats," Horner said. As a result, B&N doesn't "think of printed books and e-books as distinct anymore. When we think of promoting books, we think in a totality."

Hilt stressed that B&N's store will always be the "most strategic part of us as a bookseller" although its role is evolving. "The Nook space in stores has expanded, and we're continuously testing."

--- The digital shift is happening faster than predicted, David Naggar, v-p, global Kindle content acquisition for Amazon, said. Digital now represents 20% of U.S. publishers' sales in dollars, and Amazon is now selling more Kindle books than print books in both the U.S. and U.K. "The transition is happening quickly and accelerating."

The digital shift is happening faster than predicted, David Naggar, v-p, global Kindle content acquisition for Amazon, said. Digital now represents 20% of U.S. publishers' sales in dollars, and Amazon is now selling more Kindle books than print books in both the U.S. and U.K. "The transition is happening quickly and accelerating."

Readers who have been Amazon customers for at least a year buy three times as many print and digital books after they purchase a Kindle, David Naggar said.

Nook owners also "consume three times the content than before," Hilt said, usually "a combination of digital and print." "If they were buying print, they still buy print books and use the Nook to enhance their library. We've learned that the print book isn't dead." In addition, new owners of the Nook buy "a tremendous amount of content for three to six months and then move into a more natural state of usage."

E-book sales are growing around the world. In one example, Naggar said that Santillana, Spain's third largest publisher, had put its backlist on the Kindle. Before doing so, the ratio of sales of Santillana backlist titles in the U.S. to its other markets was 1:15; since the Kindle move, the ratio is 2:1. Some 80% of Santillana's titles on the Kindle had at least one sale, Naggar said. "It's not just one backlist title driving sales."

Stephen Page, publisher and CEO of Faber & Faber, said that because of e-books, the 85-year-old publishing house this year sold books in 20 countries where it had never sold a single book in the past.

And Michael Tamblyn, executive v-p of content, sales and merchandising for Kobo, cited growth of 300% in sales of English-language e-books to non English-speaking countries in the past year.

Tamblym also noted the importance of self-publishing in the digital world, which represents 7% of sales in North America and goes as high as 14% in Africa. The most popular self-pubbed categories are romance, erotica, thrillers, science fiction, mystery, horror and fantasy. The few nonfiction titles that sell well are in health, yoga and diet.

Self-publishers experiment regularly, some daily, with e-book prices, Tamblyn said, but large publishers, particularly those who sell under the agency plan, tend to price the way they do for printed books. "They set and forget," Tamblyn said. "They don't look at the performance of specific books to see if there is room to maneuver."

Horner perhaps had the best comment of the day in the uncertain e-world, saying, "It's okay not to be a total success if you can fix it the next day or the next day after that or the next day after that." --John Mutter

SHELFAWARENESS.0213.S4.DIFFICULTTOPICSWEBINAR.gif)

Connecticut is the latest state to

Connecticut is the latest state to

"What began as a dream of local literary force Kim Ricketts has been realized by Lara Hamilton, who took over Kim Ricketts Book Events before its beloved founder passed away,"

"What began as a dream of local literary force Kim Ricketts has been realized by Lara Hamilton, who took over Kim Ricketts Book Events before its beloved founder passed away,"  Martin Carmody has opened

Martin Carmody has opened SHELFAWARENESS.0213.T3.DIFFICULTTOPICSWEBINAR.gif)

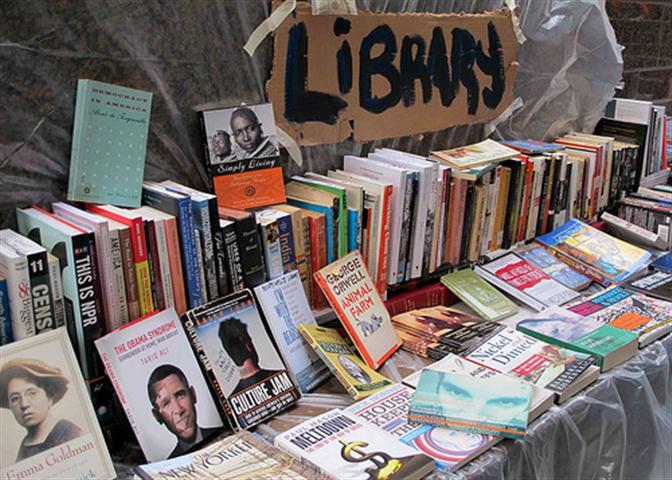

Chelsea Green is donating 1,500 copies of its books to the Occupy Wall Street protesters in New York City for distribution and use in their education centers, according to

Chelsea Green is donating 1,500 copies of its books to the Occupy Wall Street protesters in New York City for distribution and use in their education centers, according to  Simon & Schuster has launched

Simon & Schuster has launched

O'Connell loves a great bookstore as much as the next bibliophile, but he does not live near one in his Dublin suburb, and has discovered that the "small and frankly feeble set-up" of his local bookstore often yields unexpected treasures.

O'Connell loves a great bookstore as much as the next bibliophile, but he does not live near one in his Dublin suburb, and has discovered that the "small and frankly feeble set-up" of his local bookstore often yields unexpected treasures.  Point Arena High School student Kailey Schmidt, 16, helped Joel and Jeremy Crockett, owners of Four-Eyed Frog Books, Gualala, Calif., produce their video "

Point Arena High School student Kailey Schmidt, 16, helped Joel and Jeremy Crockett, owners of Four-Eyed Frog Books, Gualala, Calif., produce their video " Police in Tunisia arrested 50 Islamist protesters "for an attempted arson attack on the Tunis offices of satcaster Nessma TV after it screened

Police in Tunisia arrested 50 Islamist protesters "for an attempted arson attack on the Tunis offices of satcaster Nessma TV after it screened  Katherine Malmo is the author of

Katherine Malmo is the author of  Your top five authors:

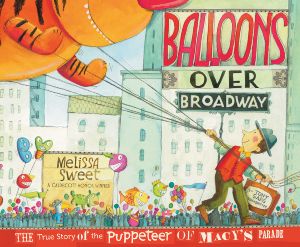

Your top five authors: Have you ever thought about how balloons came to dominate the Macy's Thanksgiving Day Parade? From this day forward you won't be able to look at them without thinking of Tony Sarg.

Have you ever thought about how balloons came to dominate the Macy's Thanksgiving Day Parade? From this day forward you won't be able to look at them without thinking of Tony Sarg.