Readerlink Buying Baker & Taylor

Readerlink Distribution Services, which specializes in supplying books to non-trade booksellers such as Walmart, Target, grocery stores, and warehouse clubs, is buying Baker & Taylor, which primarily supplies the library market. According to a letter yesterday to "publishing partners" from Readerlink president and CEO Dennis E. Abboud, Readerlink will acquire "the business and substantially all the of assets" of B&T. Closing is expected on September 26.

Readerlink Distribution Services, which specializes in supplying books to non-trade booksellers such as Walmart, Target, grocery stores, and warehouse clubs, is buying Baker & Taylor, which primarily supplies the library market. According to a letter yesterday to "publishing partners" from Readerlink president and CEO Dennis E. Abboud, Readerlink will acquire "the business and substantially all the of assets" of B&T. Closing is expected on September 26.

With the purchase, "most of the current Baker & Taylor management team and employees will be joining the ReaderLink team, and Aman Kochar, Baker & Taylor’s CEO, will continue to lead the Baker & Taylor business," reporting to Abboud.

Abboud noted that "certain suppliers have outstanding account balances with Baker & Taylor, which will remain with the current ownership. We have been advised that in the coming weeks the current owners or their advisors will provide guidance regarding the process for submitting claims related to pre-closing open invoices." Readerlink will, however, be the guarantor for any post-closing debts.

Abboud observed that "the last several months have been a challenging period for Baker & Taylor. The company has faced headwinds, including the pressures of operating independently, emerging from the Covid-19 pandemic, and overcoming the debilitating impacts and financial losses resulting from cyberattacks in 2022." The library world has also suffered from budgetary pressures at all levels of government as well as waves of book bannings and anti-librarian laws and campaigns.

Readerlink was created in 2011, when the Chas. Levy Company sold its subsidiary, Levy Home Entertainment, to an investment company headed by Abboud, who had been a Levy executive in the 1990s. He renamed the company in order to emphasize the link between publishers, retailers, and readers.

Founded in 1828, Baker & Taylor is the preeminent supplier of books, software, and services to public and academic libraries and schools. Through B&T Publisher Services, it also provides sales and distribution services to publishers. In recent decades, it has been owned by several private equity firms. In 2016, Follett bought B&T and sold it in 2021 to a private investment group headed by president and CEO Amam Kochar. Kochar had been an executive at B&T since 2014.

Laura Cummings (l.), owner of White Birch Books, North Conway, N.H., and a former NEIBA president, with Andrew Krivak, author of Mule Boy (Bellevue Literary Press).

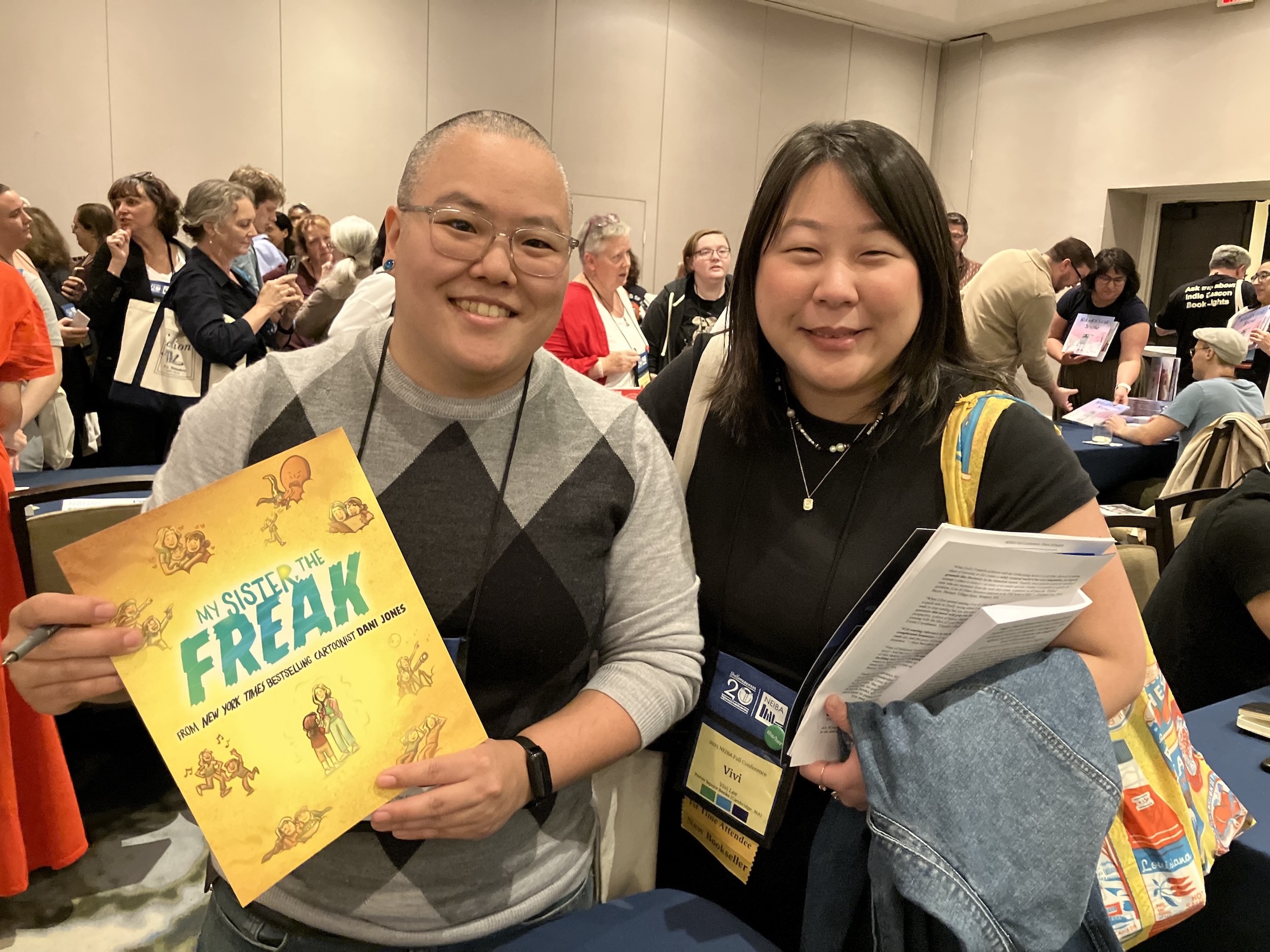

Laura Cummings (l.), owner of White Birch Books, North Conway, N.H., and a former NEIBA president, with Andrew Krivak, author of Mule Boy (Bellevue Literary Press). Dani Jones (l.), graphic novel author/illustrator of the Frankinschool and PopularMMOs series with bookseller and first-time NEIBA attendee Vivi Lee of Porter Square Books in Cambridge, Mass., highlight Jones's upcoming graphic novel, My Sister, the Freak (HarperAlley).

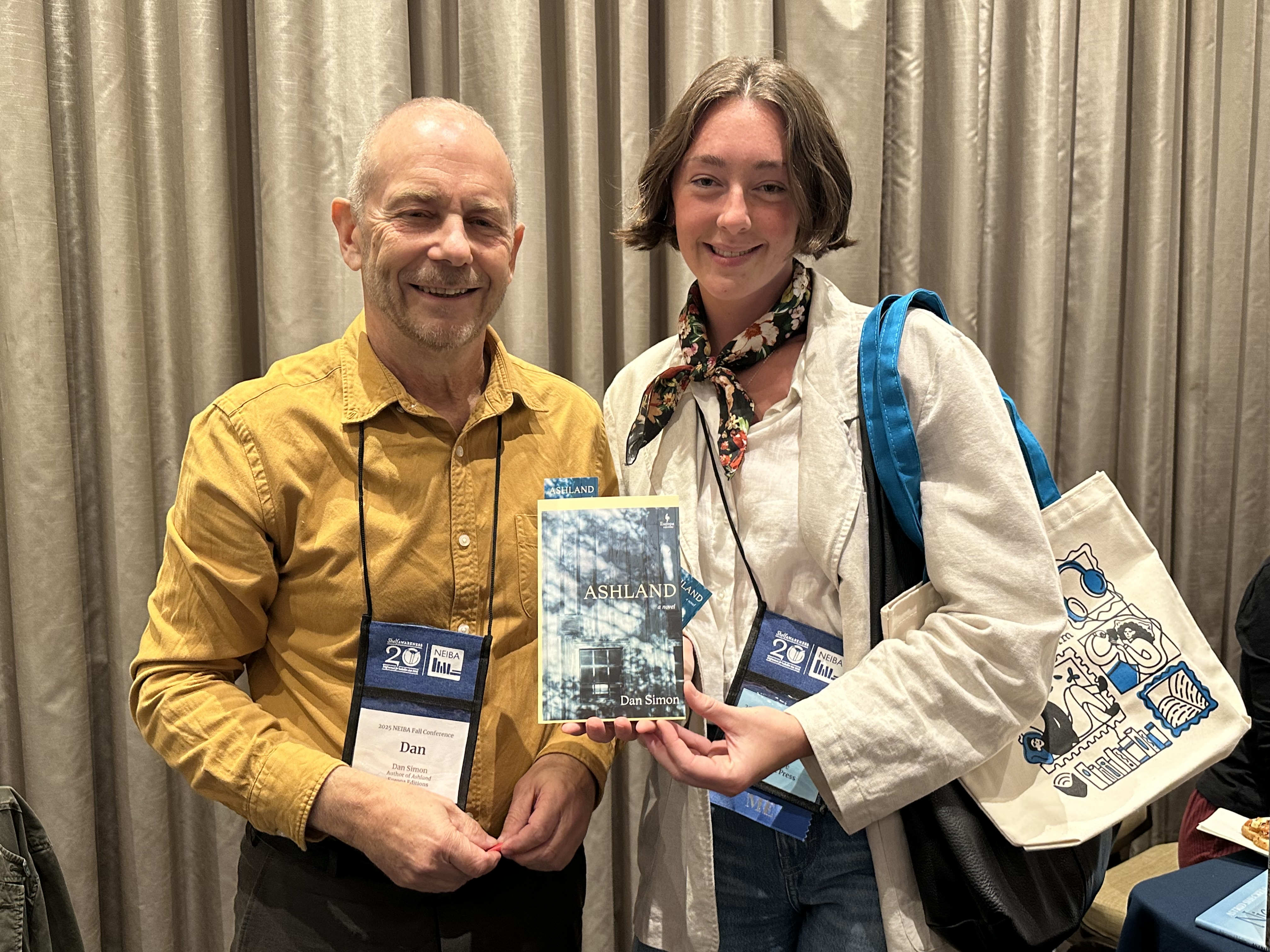

Dani Jones (l.), graphic novel author/illustrator of the Frankinschool and PopularMMOs series with bookseller and first-time NEIBA attendee Vivi Lee of Porter Square Books in Cambridge, Mass., highlight Jones's upcoming graphic novel, My Sister, the Freak (HarperAlley). Dan Simon (l.), founder and publisher of Seven Stories Press, whose upcoming debut novel is Ashland (Europa Editions), with Katie Lowe, Islandport Press, Yarmouth, Maine.

Dan Simon (l.), founder and publisher of Seven Stories Press, whose upcoming debut novel is Ashland (Europa Editions), with Katie Lowe, Islandport Press, Yarmouth, Maine. Traci Hays-Bryant (l.), a first-time NEIBA attendee, from Toadstool Bookshop, Keene, N.H., with Keya Chatterjee, author of The Revolution Will Not Be Rated G (Green Writers Press).

Traci Hays-Bryant (l.), a first-time NEIBA attendee, from Toadstool Bookshop, Keene, N.H., with Keya Chatterjee, author of The Revolution Will Not Be Rated G (Green Writers Press). Hannah Swearingen (l.), a first-time NEIBA attendee and bookseller at Books on the Square in Providence, R.I., with author Natalie Lemle and her 2026 title, Artifacts (S&S).

Hannah Swearingen (l.), a first-time NEIBA attendee and bookseller at Books on the Square in Providence, R.I., with author Natalie Lemle and her 2026 title, Artifacts (S&S). 10th Anniversary of the Windows & Mirrors List: In 2015, a small committee of NECBA (New England Children's Booksellers Advisory Council) members curated the first Windows & Mirrors list of diverse and inclusive children's titles. Ten years later, the list has grown and changed, with the focus remaining on titles that best represent

10th Anniversary of the Windows & Mirrors List: In 2015, a small committee of NECBA (New England Children's Booksellers Advisory Council) members curated the first Windows & Mirrors list of diverse and inclusive children's titles. Ten years later, the list has grown and changed, with the focus remaining on titles that best represent

SHELFAWARENESS.1222.T1.BESTADSWEBINAR.gif)

A romance-focused bookstore called

A romance-focused bookstore called

Love was in the air at

Love was in the air at  "

" Woodpecker: A Year in the Life of North American Woodpeckers

Woodpecker: A Year in the Life of North American Woodpeckers Technological advancement seems to be reshaping not only how people direct their attention but also the economy itself, in ways that disenfranchise the average person. The Age of Extraction by professor of law, science, and technology Tim Wu (The Master Switch; The Attention Merchants) shows how those changes are happening. As an expert in competition and antitrust policies, he exercises that knowledge while analyzing how tech platforms have altered perceptions of what competition, and the stifling of competition, among tech platforms looks like today. For example, if everyone is encouraged to use a single platform for a given service--e.g., Amazon as the primary marketplace for exchanging goods--there is little opportunity for smaller tech platforms. or even bricks-and-mortar shops, to compete.

Technological advancement seems to be reshaping not only how people direct their attention but also the economy itself, in ways that disenfranchise the average person. The Age of Extraction by professor of law, science, and technology Tim Wu (The Master Switch; The Attention Merchants) shows how those changes are happening. As an expert in competition and antitrust policies, he exercises that knowledge while analyzing how tech platforms have altered perceptions of what competition, and the stifling of competition, among tech platforms looks like today. For example, if everyone is encouraged to use a single platform for a given service--e.g., Amazon as the primary marketplace for exchanging goods--there is little opportunity for smaller tech platforms. or even bricks-and-mortar shops, to compete.