When German book wholesaler and distributor Koch, Neff and Volckmar (KNV) filed for bankruptcy in February, Europe's largest book market was deeply shaken. Coming hot on the heels of a controversial merger between two leading book chains--Thalia and Mayersche--KNV's plight added massively to the already fraught mood in the industry. If no buyer is found for the family-owned business, the implications could be severe, not only for the supply chain handled mostly by KNV together with competitors Libri and Umbreit, but for the German book industry as a whole.

When German book wholesaler and distributor Koch, Neff and Volckmar (KNV) filed for bankruptcy in February, Europe's largest book market was deeply shaken. Coming hot on the heels of a controversial merger between two leading book chains--Thalia and Mayersche--KNV's plight added massively to the already fraught mood in the industry. If no buyer is found for the family-owned business, the implications could be severe, not only for the supply chain handled mostly by KNV together with competitors Libri and Umbreit, but for the German book industry as a whole.

Six weeks on, uncertainty prevails. Many had expected an announcement during the recent spring book fair in Leipzig, one of the major events in the German book calendar. That did not happen, so the feeling of unease in an industry already fraught with problems is growing steadily and the pressure is building on Tobias Wahl, appointed as bankruptcy administrator for KNV.

Not surprisingly, Wahl, an experienced bankruptcy lawyer, is playing his cards close to his chest, while talks with possible investors are being held. Having succeeded in his first task of reassuring customers that KNV is fully operational again after a few days of disruption, he has repeatedly said that he does not want to break up the company. Instead his aim is to find an investor who takes over KNV as a going concern and will keep intact its special business model--it is both a book wholesaler and a distributor for more than 300 publishers.

Wahl has called KNV the "indispensable hinge" between publishers and book retailers. His pitch for potential investors: "KNV is based on a good, viable business model that is trusted throughout the market."

KNV's weak spot--and what many see as the root of its current problems--will undoubtedly also come under close scrutiny: the state-of-the-art logistic center that opened in Erfurt, in eastern Germany, in October 2014. Covering 170,000 square meters (about 1.83 million square feet) and costing €150 million (about $168.5 million), the warehouse was plagued by problems for a long time, although it now seems to be running smoothly.

The administrator has just published a provisional timeline: while actively looking for an investor, he will send his assessment to the bankruptcy court in Stuttgart towards the end of April, which then could open bankruptcy proceedings as soon as May 1. The first meeting of creditors is expected to take place at the end of June or early July.

Wahl has been in close contact with the German book trade association, Börsenverein des Deutschen Buchhandels, which organized eight well-attended "road shows" in major German cities to discuss the matter with booksellers and publishers. In a statement, Wahl said he has been impressed how publishers large and small, as well as booksellers, have rallied to support KNV. "I have rarely seen so much closeness, loyalty and solidarity in an industry," he wrote.

There has been one exception to that. In a blow to KNV and Wahl, wholesaler Umbreit, the third largest wholesaler after KNV and Libri, has just cancelled their joint book truck delivery service (Bücherwagendienst) set up two years ago. As of May 1, Umbreit will team up with an as-yet-unnamed logistics partner to go back to delivering orders to bookstores on its own. While KNV and Wahl regret the decision, they say they do not see major logistical problems because most of the delivery areas in question have been serviced by KNV trucks anyway.

KNV Bücherwagendienst serves about 5,600 bookstores in Germany, Austria and Switzerland. The company has 23 warehouses that ensure that 90% of all orders received by 6 p.m. will be delivered to the customer by 9 a.m. the next morning. Trust is an important issue: as most deliveries are done outside business hours, drivers carry keys to the majority of bookshops. All in all, KNV regularly stocks about 590,000 titles from more than 5,000 publishers in the German-speaking countries, of which approximately 63,000 are new media products, including DVDs, music CDs and audiobooks.

Because Germany has become an important export market for trade and academic publishers in Britain and the U.S., developments in Stuttgart are also closely watched by many in the international book community. To stock more than 54,000 English-language titles, KNV has built up close ties with Baker & Taylor and Gardners. --Anja Sieg, international editor, buchreport

When German book wholesaler and distributor Koch, Neff and Volckmar (KNV) filed for bankruptcy in February, Europe's largest book market was deeply shaken. Coming hot on the heels of a

When German book wholesaler and distributor Koch, Neff and Volckmar (KNV) filed for bankruptcy in February, Europe's largest book market was deeply shaken. Coming hot on the heels of a

Last Thursday, the American Booksellers Association's e-newsletter edition of the Indie Next List for April was delivered to more than half a million of the country's best book readers. The newsletter was sent to customers of 139 independent bookstores, with a combined total of 541,883 subscribers.

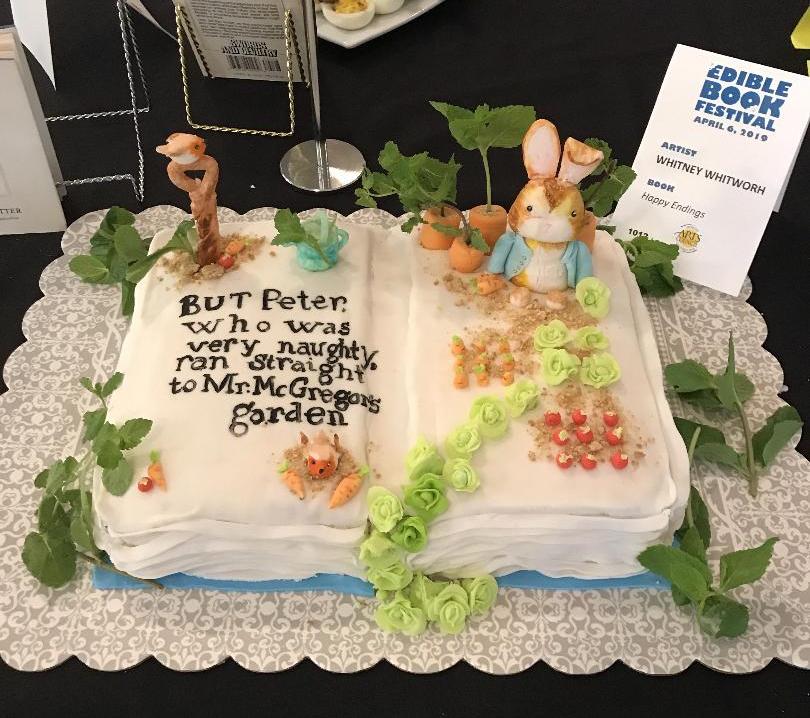

Last Thursday, the American Booksellers Association's e-newsletter edition of the Indie Next List for April was delivered to more than half a million of the country's best book readers. The newsletter was sent to customers of 139 independent bookstores, with a combined total of 541,883 subscribers. The seventh annual Shoreline-Lake Forest Park Arts Council Edible Book Festival was held on Saturday, near Seattle, and one of the most popular cakes was this one for Peter Rabbit. (photo: Devon Ashby)

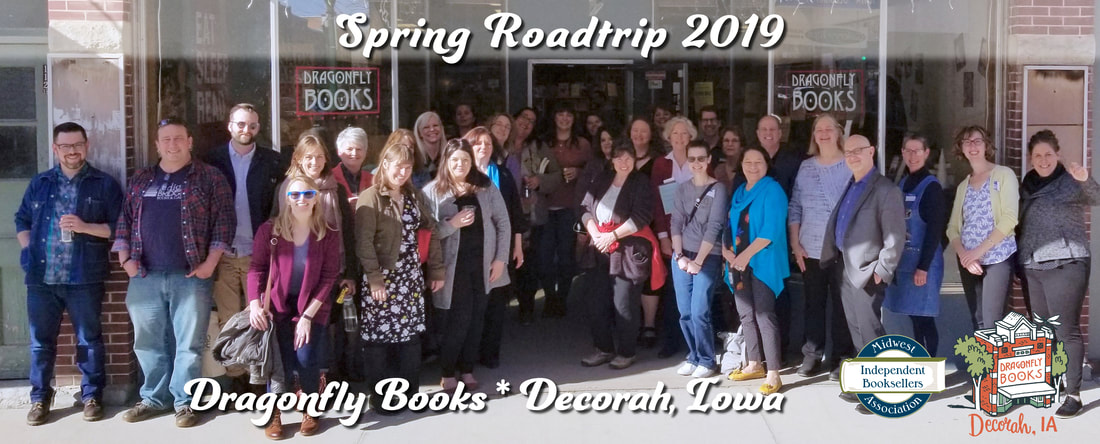

The seventh annual Shoreline-Lake Forest Park Arts Council Edible Book Festival was held on Saturday, near Seattle, and one of the most popular cakes was this one for Peter Rabbit. (photo: Devon Ashby) On March 25, the Midwest Independent Booksellers Association held its first Spring Roadtrip, to

On March 25, the Midwest Independent Booksellers Association held its first Spring Roadtrip, to  Little Lovely Things

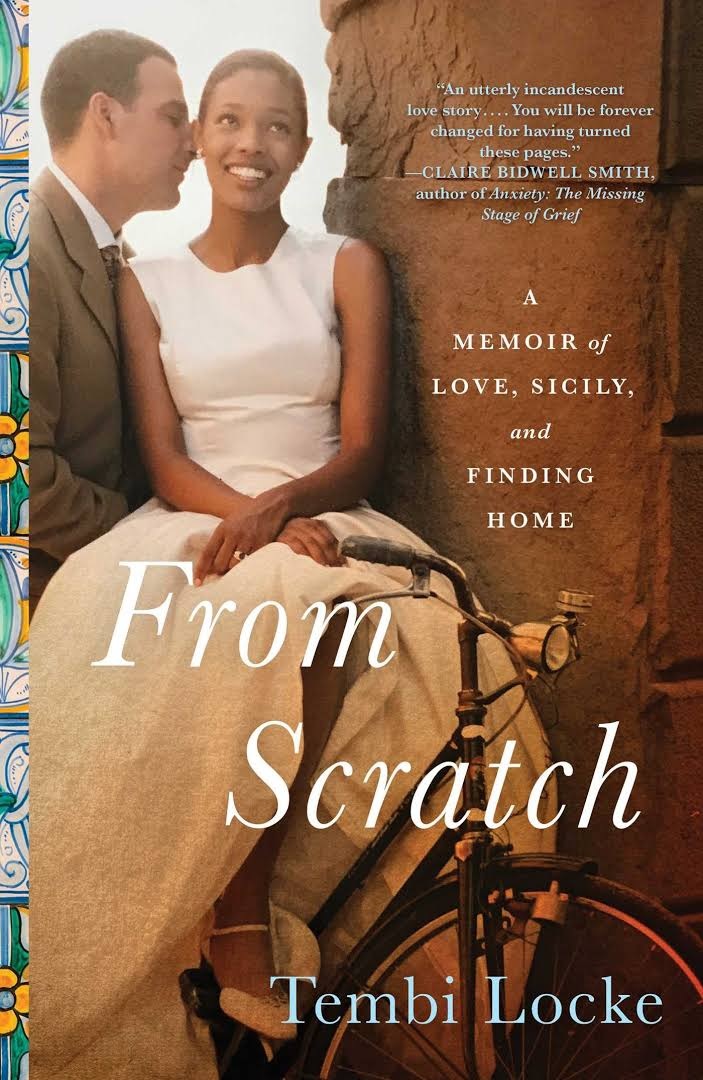

Little Lovely Things It may sound familiar: an American woman goes to Italy, indulges in love, wine and good food, and leaves sensually and spiritually transformed. But while this template technically describes From Scratch: A Memoir of Love, Sicily, and Finding Home, Tembi Locke's story is different from ones you've heard before.

It may sound familiar: an American woman goes to Italy, indulges in love, wine and good food, and leaves sensually and spiritually transformed. But while this template technically describes From Scratch: A Memoir of Love, Sicily, and Finding Home, Tembi Locke's story is different from ones you've heard before.